How to Get Out of Debt: 3 Tips That Work

Being in debt isn’t easy. Falling behind with your loan payments, rent and other bills can cause serious financial stress. It can also prevent you from reaching goals that are actually important to you, like buying your own home or saving for retirement.

Turning around your financial situation doesn’t happen overnight. It requires changing your spending habits and having strong self-discipline.

The good news is that with the right plan and mindset, you can get out of debt much faster than you think.

Here are 3 effective tips that help you take control of your finances.

1. Download a Personal Finance App

Monitoring your expenses, sticking to a budget and building savings – all of this can be a lot to keep track of. Fortunately, there are many tools available that can help you. A great solution is to start using a budgeting app. Nowadays we use different apps for almost anything: from ordering food to working out and booking appointments. So why shouldn’t we do the same for managing our finances?

Here are some recommendations:

Squirrel

Squirrel is a budgeting app that does all the work for you. All you need to do is insert your monthly expenses, saving goals and weekly allowance. Based on this data, Squirrel won’t even let you use the money before you actually need it. For example, if you have to pay £600 for rent, the money will be released just one day before the payment is due.

Cost: three-month free trial, after that £9.99 / month

Available for: Android, iOS, Web

Cleo

Cleo is an app that makes budgeting a lot more fun. You can link all your bank accounts to your Cleo account, the app then analyses all your transactions and gives you an overview of your spendings. Cleo is like your personal assistant – you can chat with it on Facebook Messenger and get answers to all your finance-related questions.

The Cleo app also includes a ‘roast mode’ where the chatbot uses sarcasm to make fun of your spending habits.

Cost: basic version is free, Cleo Plus £5.99 / month

Available for: Android, iOS

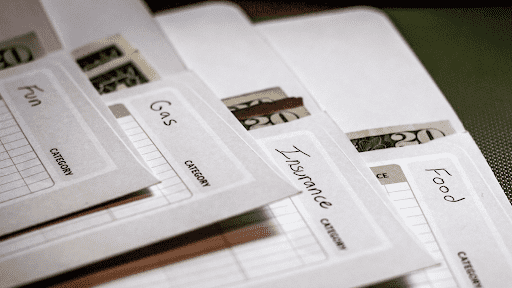

2. Use the Envelope Method

The envelope budgeting system is actually nothing new. It has been around for decades but is still one of the easiest ways to control your expenses and track your spending.

So what is the envelope system?

It’s a money management technique that divides your money into different spending categories. It’s a highly visual method as all spending is done in cash and you can see exactly where your money is going.

Before you start, you need to determine how much money you have left after you’ve paid all your bills. Once you’ve done that, follow these simple steps:

- Categorize all your expenses (for example transportation, groceries, entertainment etc) and set a budget for each expense. Try to avoid “miscellaneous” categories, as you should know exactly where your money is going.

- Get an envelope for each category and put in the budgeted amount.

- Spend from the envelopes.

- Once the envelope is empty, it means that you can’t spend from that category until the next month.

- Review your spending: check your budget every month and make changes if necessary.

3. Review your Subscriptions

One of the simplest hacks to save money and get of debt is to cut expenses that you don’t need. With so many services being subscription-based these days, it’s easy to lose track of your money. Look through your bank account statement and find all the subscriptions that you are no longer using. If you are never going to the gym, cancel the membership and add this money to your savings account. These subscriptions might not cost too much individually but it definitely adds up quite a bit. And it’s the money that you could be saving!

Stay on course

Focus is the key to getting out of debt fast. Things will probably happen to get you off track: unexpected expenses will come up or something you really want will go on sale. That’s why it’s important to keep in mind your long-term goals and what your life will be like in the future if you stick to the plan.